Overview

An estimated 42.9 million Americans, particularly younger adults, have student debt. On average they owe $32,731, with variability by race/ethnicity and gender. Black college graduates owe $25,000 more than their White counterparts; women hold about two-thirds of all student debt.

Concern about the burden of student debt has been heightened by the COVID-19 pandemic. In response to college closures and economic turbulence generated by the pandemic, policymakers suspended federal student loan payments and set the interest rate on federal student loans at 0%. To provide further relief, Congress is currently considering forgiving federal student loan debt of $10,000 to $50,000 per borrower.

Information about student debt among LGBTQ adults is missing from student loan forgiveness discussions. Using data collected from U.S. adults on the 2021 nationally representative Access to Higher Education Project survey, this brief aims to fill gaps in knowledge about student debt, with an emphasis on federal student loans, among LGBTQ adults ages 18-40. Additional details about study methods, as well as detailed tables about federal loans, are included in the Appendix.

Student Debt

- Over a third (39.4%) of LGBTQ adults ages 18 to 40 have student debt in the form of federal student loans, private student loans from a bank or other lending institution, or from credit cards or other loans.

- Most (90.0%) of these adults have federal student loans. Thus, the remainder of this fact sheet focuses on federal student loan debt and debt among federal loan holders.

Federal Student Loans

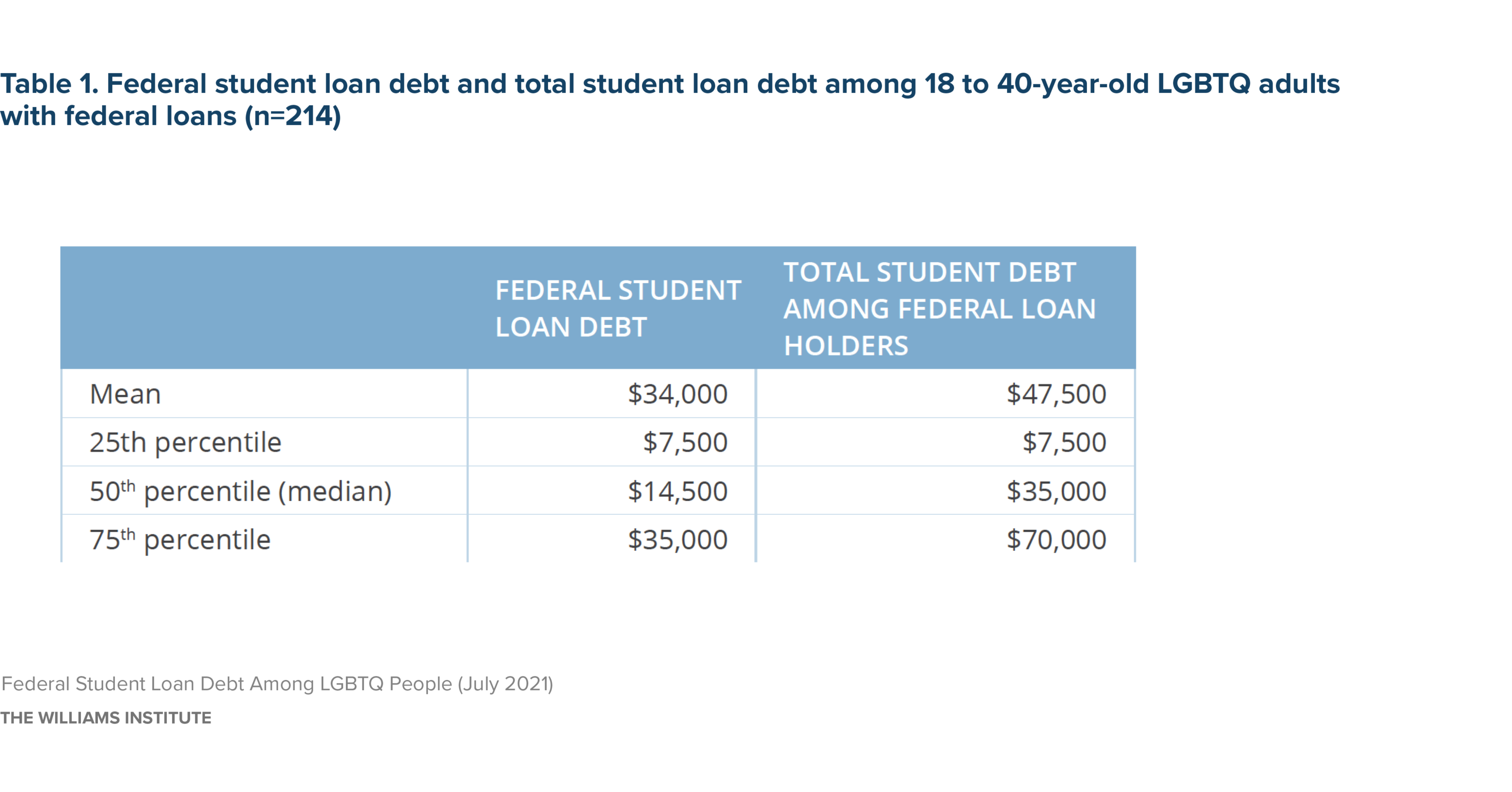

- More than a third (35.4%) of LGBTQ adults ages 18 to 40, an estimated 2.9 million adults, are holding more than $93.2 billion in federal student loans.

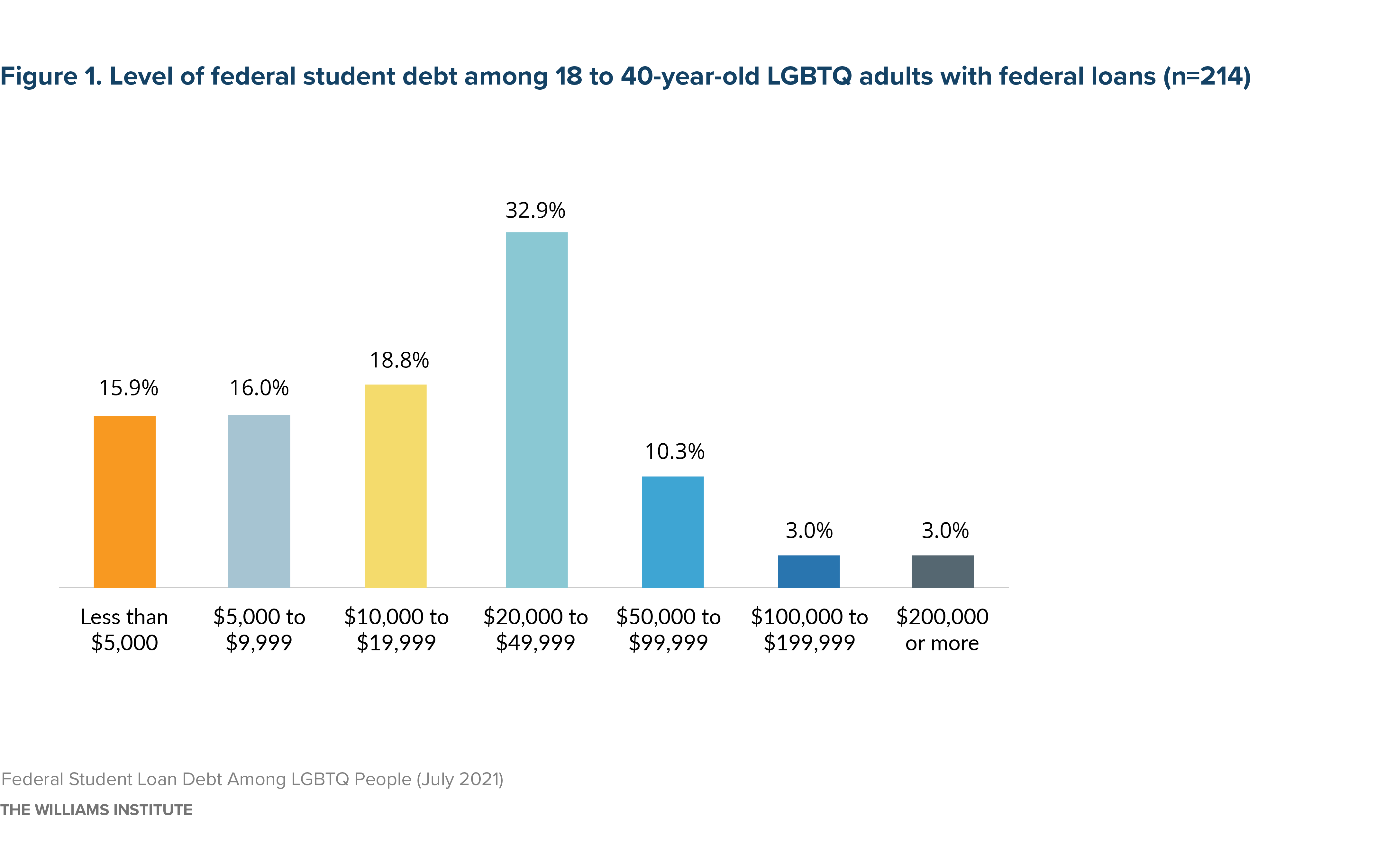

- Of these 2.9 million LGBTQ federal student loan holders, about a third (32.0%) owe less than $10,000, about half (51.7%) owe between $10,000 to under $50,000 and the remainder (16.3%) owe $50,000 or more in federal student loans.