The Biden administration prioritized providing relief to the approximately 43 million adults in the United States with student loan debt. The Trump administration has indicated that this relief will be stopped or greatly curtailed. In addition, the Trump administration and some members of Congress have proposed policies to reduce the availability of federal student loans moving forward, to make such loans more costly, and to make them less easy to discharge. These policy changes would disproportionately impact LGBTQ adults, who are more likely to have student loan debt than non-LGBTQ adults. In particular, curtailing student loan debt relief would impact transgender adults, LBQ cisgender women, LGBTQ people of color, LGBTQ people with disabilities, and LGBTQ people who work in the nonprofit sector.

Impact of Changes to Federal Student Loans Programs on LGBTQ Adults

The Trump administration and Congress are implementing various mechanisms to change the federal student loan program. This study analyzes student loan policies under both the Biden and Trump administrations and examines how changes in the availability and forgiveness of student loans could impact LGBTQ college students.

Student Loan Debt Among LGBTQ Adults

Data collected from adults in the U.S. through the Williams Institute’s 2021 Access to Higher Education Project survey, a nationally representative sample created through a joint initiative of the Williams Institute and Point Foundation, found that among LGBTQ adults ages 18-40:

- More than one-third (35%)—an estimated 2.9 million LGBTQ adults—were holding more than $93.2 billion in federal student loans.

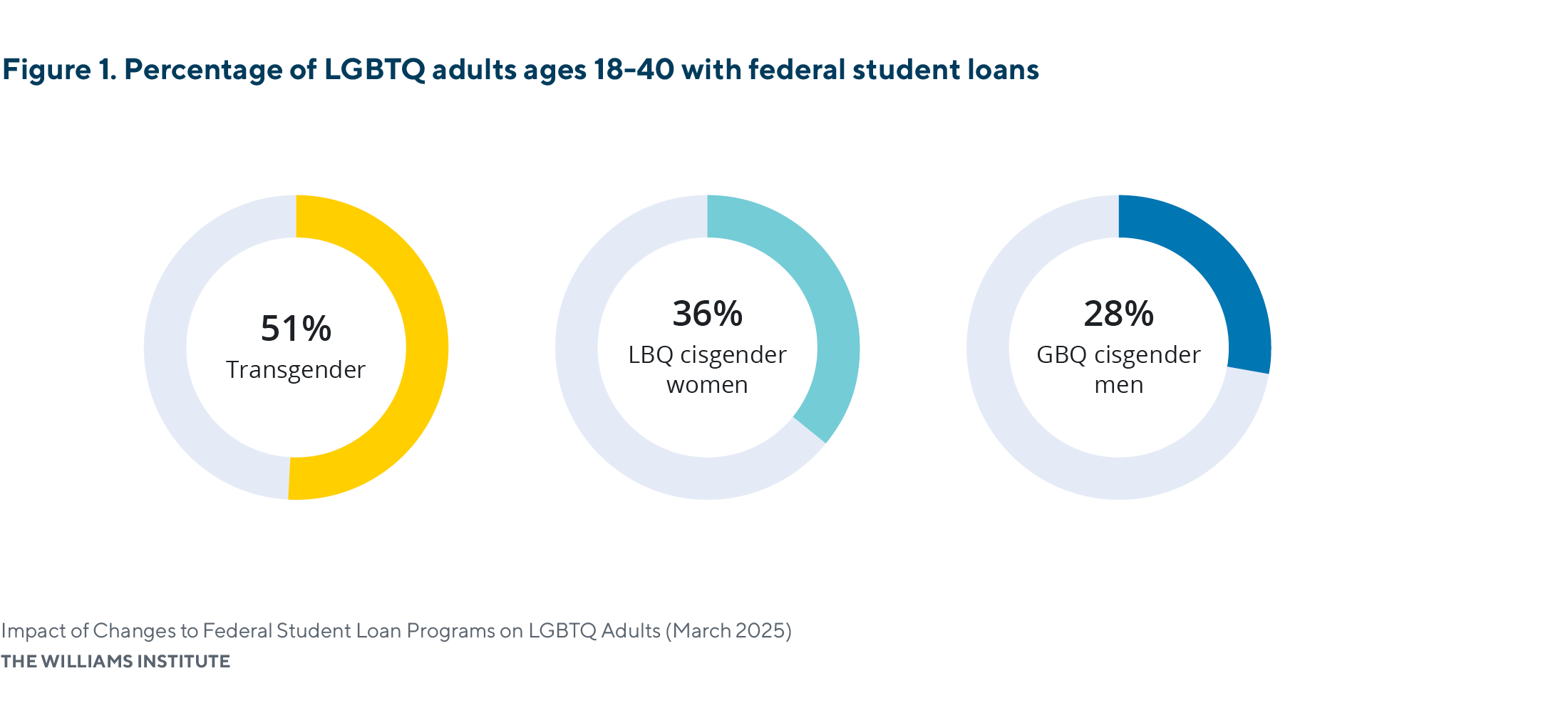

- About half (51%) of transgender adults, 36% of cisgender LBQ women, and 28% of cisgender GBQ men had federal student loans.

- About one-third of white LGBTQ adults (37%) and LGBTQ people of color (33%) have federal student loans.

- LGBTQ adults ages 18-40 are more likely to have federal student loans than non-LGBTQ adults (35% vs. 23%); these differences persisted even after taking into account differences in the age composition of the two groups (age-adjusted odds ratio 1.8; 95% confidence interval, 1.3, 2.5).

- Of these 2.9 million LGBTQ federal student loan holders, about one-third (32%) owed less than $10,000, about half (52%) owed between $10,000 to under $50,000, and the remainder (16%) owed $50,000 or more in federal student loans.

Student Loan Debt Relief under the Biden Administration

The Biden administration approved over $183 billion in student debt relief for more than five million borrowers. The major initiatives to accomplish this relief included:

- Closed schools and/or fraudulent loans. The Biden administration provided approximately $30 billion in relief to more than 1.7 million borrowers who were defrauded by their schools, saw their institutions precipitously close, or were covered by related court settlements.

- SAVE and Income-Driven Repayment Programs. Through adjustments to existing repayment plans and the creation of more accommodating income-driven repayment (IDR) plans, including the Saving on a Valuable Education (SAVE) plan, the Biden administration provided $56.5 billion in relief to 1.4 million borrowers. These plans, in particular, help those with lower incomes. Notably, borrowers making less than 225% of the federal poverty level were not required to make any payments under the SAVE plan.

- Improving the Public Service Loan Forgiveness Program (PSLF). The PSLF program provides loan forgiveness to those who work for 10 years in public service, broadly defined as employment in any local, state, or federal government job or nonprofit sector. Through regulatory improvements and a temporary waiver program, the Biden administration provided loan forgiveness totaling $78.5 billion to 1,069,000 million borrowers through PSLF.

- Borrowers with a total and permanent disability. The Biden administration also provided $18.7 billion in relief to over 633,000 borrowers with a total and permanent disability who were unable to work.

If LGBTQ adults were just as likely as non-LGBTQ adults to receive student loan relief under these initiatives, then approximately 336,000 LGBTQ adults (11.6% of LGBTQ adults with student loans) received relief under the Biden administration’s loan forgiveness programs. However, it is likely that even more LGBTQ adults received such relief.

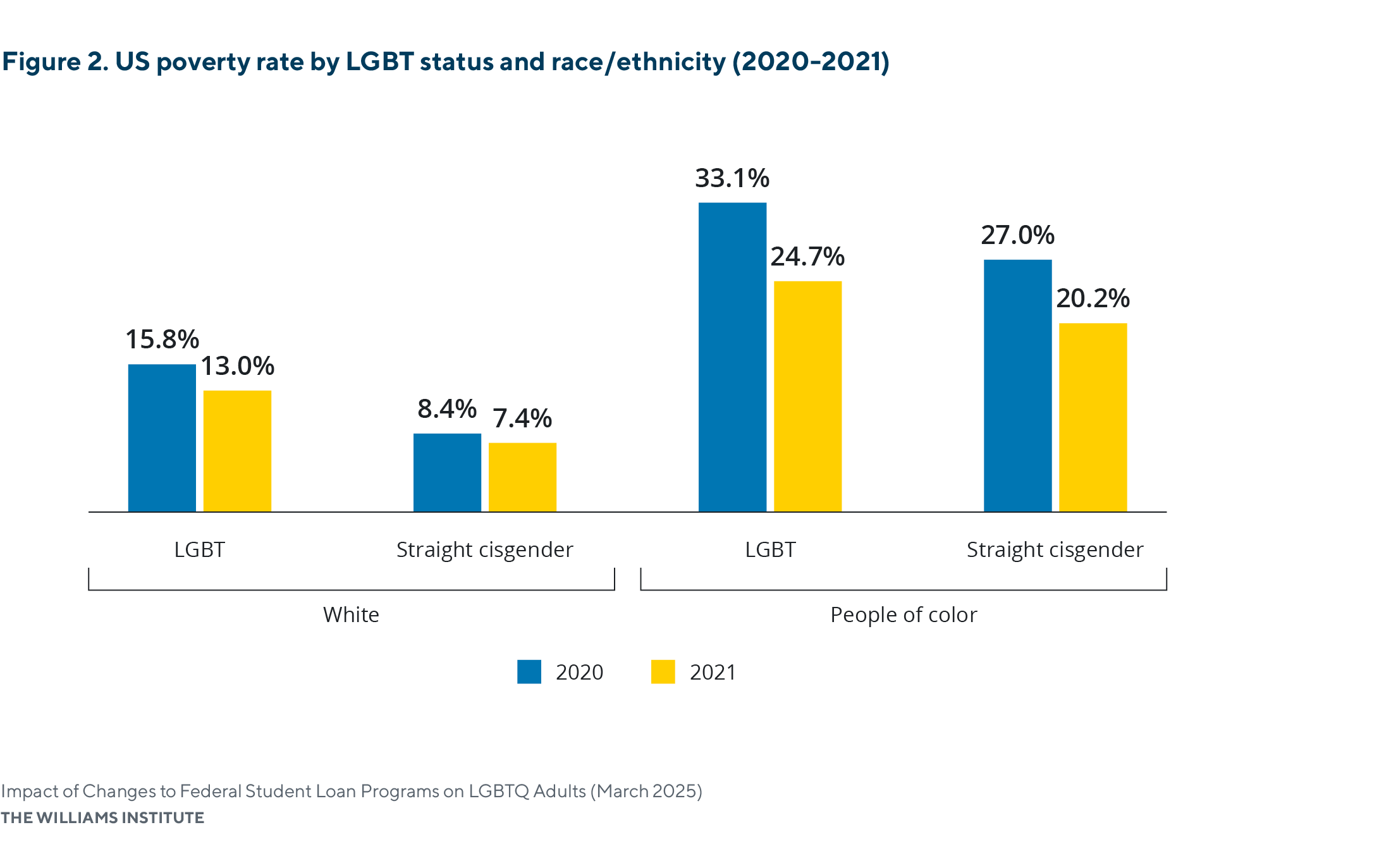

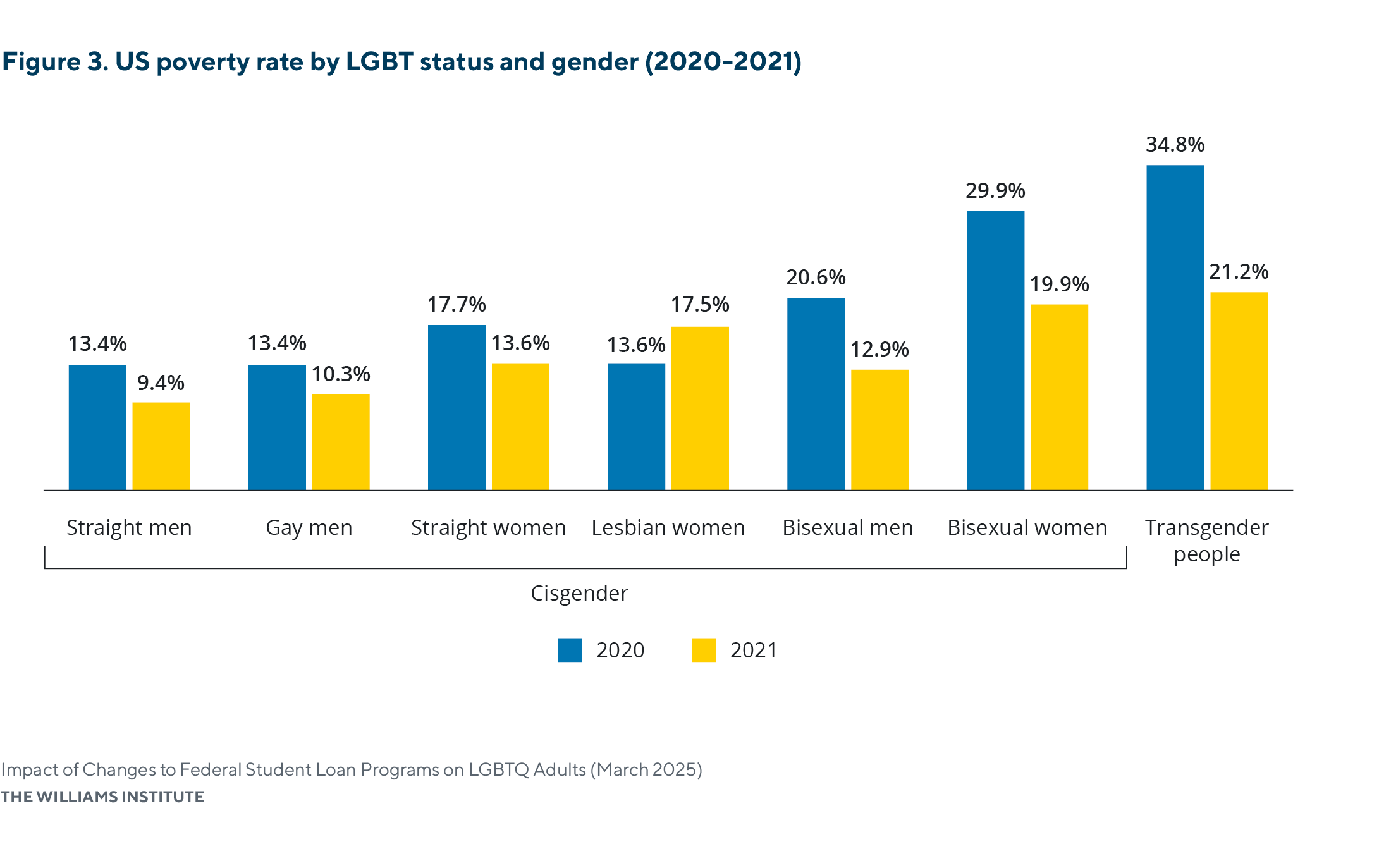

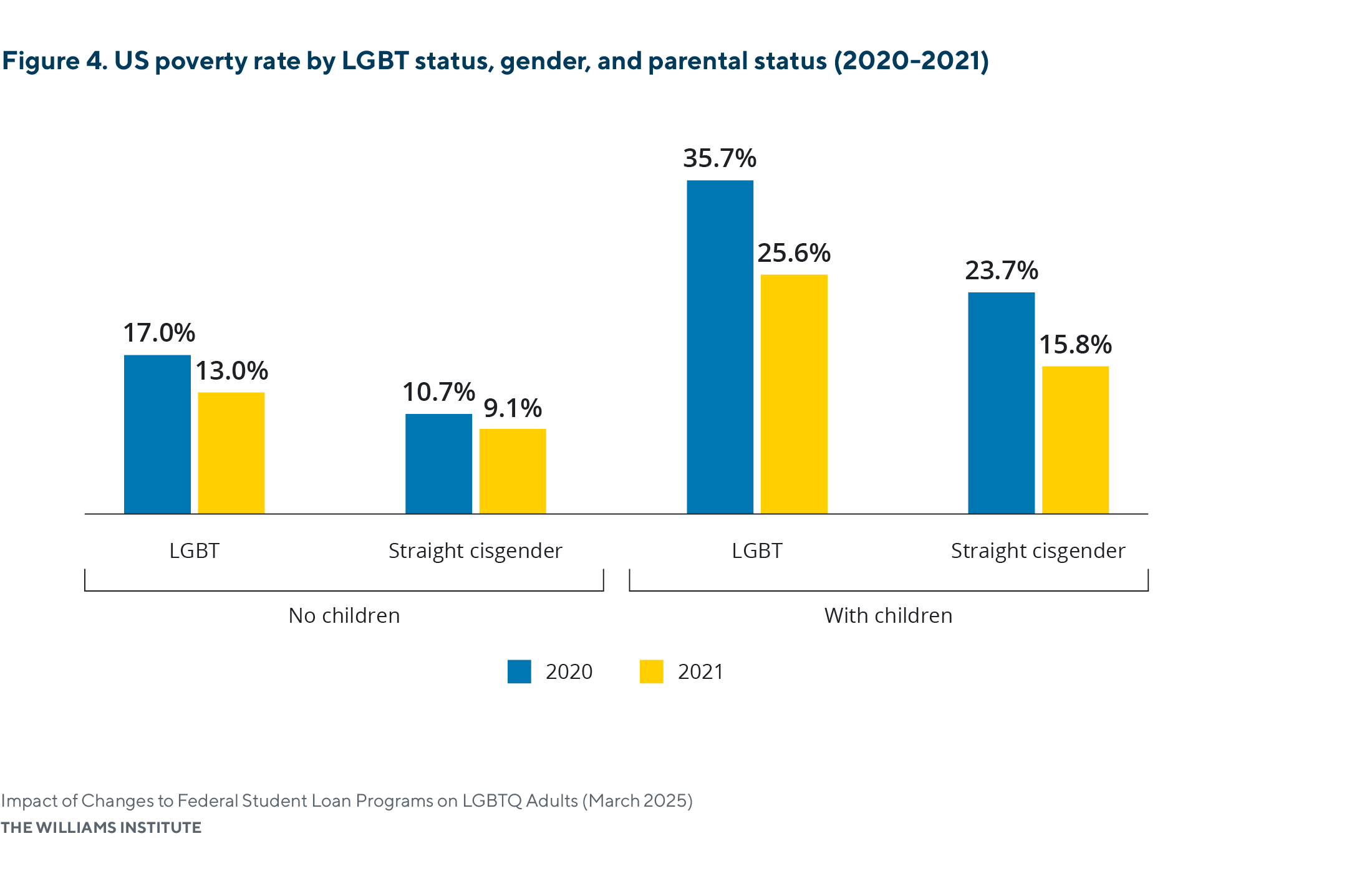

- LGBTQ people are more likely to live in poverty or have low incomes. To the extent that IDR plans provide relief for those with low incomes, LGBTQ adults are more likely to have benefited. In particular, LGBTQ people of color, LBQ women, transgender adults, and LGBTQ adults with children are more likely to be living in poverty or have low incomes.

- Many LGBTQ adults work in the public and nonprofit sectors. Much of the relief from the Biden administration has been through the Public Service Loan Forgiveness program. According to the most recent Household Pulse Survey data, about one in four (24%) LGBT people who are currently employed work in the public or nonprofit sectors.

- LGBTQ adults are more likely to have a disability. People with disabilities have been helped through the Biden administration’s initiatives because they are more likely to live in poverty or with low incomes than non-disabled people and may also qualify for relief if they have a total and permanent disability. LGBTQ people are more likely to be living with a disability than non-LGBTQ people. A 2019 Williams Institute study found that over a third of lesbian and bisexual women (35%) and transgender people (35%), and more than a quarter of cisgender gay and bisexual men (28%), are living with a disability compared to 19% of cisgender straight men and 24% of cisgender straight women. A 2023 analysis of Household Pulse Survey data similarly found that 13% of non-LGBT adults had a disability compared with 21% of LGBT adults and 38% of transgender adults. The poverty rate for adults with disabilities (27%) is more than twice the rate of adults with no disability (12%).

Trump Administration Proposals Related to Federal Student Loans

The Trump administration has been critical of Biden’s approach to student loan relief. In addition, Congress plans to use the FY25 budget reconciliation process to achieve key policy goals related to student loan relief championed by the Trump administration. After Congress passes its FY25 Budget Resolution, the reconciliation process begins, allowing for the expedited passage of legislation to help the Trump administration achieve key policy goals, including curtailing the Biden administration’s focus on student loan relief.

In a leaked document released on January 17, 2025, a House Budget Committee memo detailed potential reconciliation legislation proposals, including proposals targeting higher education institutions, consumer protections, and student loan borrowers. These proposals mirror much of the College Cost Reduction Act (CCRA), legislation introduced in the last Congress. A recent report found if passed, the CCRA would increase monthly student loan payments by almost $200 a month for a borrower with average income for a recent bachelor’s degree graduate.

If the Trump administration and Congress pursue student loan-related policy initiatives articulated both in Project 2025 and in the leaked House Budget Committee’s reconciliation memo, adults with student loans, including LGBTQ borrowers, would be impacted in the following ways:

Ending the SAVE income-driven repayment and other income-driven repayment plans.

As of February 18, 2025, the Biden administration’s SAVE program was blocked by the Eighth Circuit Court of Appeals. Biden’s plan, launched in 2023, offered borrowers lower payments and a quicker pathway to loan forgiveness. Before federal judges intervened, the Department of Education had forgiven more than $5 billion in loans for 414,000 borrowers under SAVE. Currently, 8 million borrowers are waiting for federal courts to make a final determination about the plan.

Project 2025 calls for the end of SAVE and other income-driven repayment plans. Project 2025 proposes phasing out existing income-driven repayment (IDR) plans for student loan borrowers, including the SAVE plan, and replacing it with just one IDR plan. The Project 2025 repayment plan would offer more limited flexibility to account for borrowers’ finances and eliminate SAVE’s cap on interest on student loans. The Center for American Progress has estimated that replacing the original SAVE plan with the Project 2025 plan would increase the typical borrower’s annual student loan payments by $2,700 to $4,000 per year, depending on the type of degree. Even after accounting for limitations to the SAVE program currently imposed by courts, the Project 2025 plan would increase borrowers’ payments by 1.3 to 2 times more per month, with increased payments totaling $1,822 annually.

In addition, the Project 2025 plan would disproportionately impact those living in poverty or with low incomes. The Project 2025 plan would lower the income threshold at which borrowers are required to make payments from $34,000 (225% of the federal poverty line) under SAVE to the federal poverty line—$15,000 for a single person and $31,000 for a borrower with a family of four.

Ending the Public Service Loan Forgiveness (PSLF) Program

In his first term, President Trump proposed eliminating the PSLF program on several occasions. Project 2025 proposed eliminating any time-based and occupation-based student loan forgiveness programs. This would include PSLF and several other programs set up to support teachers, firefighters, and other public servants.

On March 7, 2025, President Trump took a step toward limiting PSLF by signing an executive order aimed at curtailing eligibility for student loan borrowers working at certain nonprofit organizations. The order directs the Secretary of Education to revise the definition of “public service” to exclude nonprofits engaged in work the Trump administration considers to be for a “substantial illegal purpose.” The order defines activities of “substantial illegal purpose” to include the “aiding and abetting” of violations of federal immigration laws, “supporting terrorism,” “child abuse,” including the “chemical and surgical castration or mutilation of children or the trafficking of children to so-called transgender sanctuary States,” or engaging in a pattern of “violating state laws.” A separate executive order defines “chemical and surgical castration or mutilation of children” to mean the use of gender-affirming care, such as puberty blockers and hormones, by young transgender people under age 19.

While an act of Congress would be required to eliminate the PSLF program entirely, the administration of PSLF under the prior Trump administration demonstrates how bureaucratic obstacles could limit the reach of the program: only 7,000 people total had their loans forgiven prior to the Biden administration, while over one million people had their loans forgiven under PSLF during the Biden administration.

Alongside proposals to end SAVE and limit eligibility for PSLF, recent legislative proposals from Congress include removing nonprofit status from hospitals and nonprofit organizations with “ties to terrorist organizations.” If an employer’s 501(c)(3) tax exemption status is changed, any payments made by an employee through PSLF after the change do not count toward the 120 payments to a public interest employer required by the PSLF program. This provides some insight into how the Trump administration may attempt to further limit loan forgiveness options for borrowers through tax exemption eligibility limitations.

Eliminating the Department of Education entirely.

Project 2025 calls for breaking up the Department of Education and dispersing education-related programs to other departments. Eliminating the Department of Education has also been a priority of President Trump, who reiterated his goal of closing the Department of Education by Executive Order and with Congress on February 12, 2025. While eliminating the Department of Education would require an act of Congress, in November 2024, the Returning Education to Our States Act was introduced to do just that. The bill would move student loan programs to the Department of the Treasury. While not directly changing any of the federal student loan programs, the move could result in confusion, disruption, and a change in focus in implementing the programs. Prior experience under the Trump administration with PSLF demonstrates the negative impact that such disruption, confusion, and a realignment of values can have on student loan forgiveness programs.

Risk-shifting to institutions of higher education

In alignment with President Trump’s recent executive orders targeting higher education institutions, potential reconciliation proposals from the House Budget Committee include requiring postsecondary institutions to make annual “risk-sharing” payments to participate in the federal student loan program. This risk-shifting model is mirrored in a bill recently introduced in Congress that would “impose a financial penalty on certain institutions of higher education with high percentages of students who default or make insufficient payments on Federal student loans.”

Requiring colleges and universities to pay “annual risk-sharing payments” or “financial penalties” would disproportionately impact lower-income student loan borrowers and those without family financial support. To manage new costs created by these payments and penalties, colleges and universities may be forced to identify new cash flow options, such as making budget cuts, increasing tuition costs, and prioritizing admittance of students from higher income backgrounds. For instance, proposed policies that impose penalties on institutions for loan payment defaults may incentivize colleges to prioritize admitting students who can pay out-of-pocket or have families that can help with loan repayments after graduation.

Limiting access to federal student loans and grants

Potential “cost-saving” proposals for reconciliation by the House Budget Committee include changing calculations for federal student aid totals and capping Pell Grant totals based on median cost of attendance. Calculating aid based on the median cost of attendance nationwide, rather than the current formula of cost of attendance for a student’s individual program, will reduce federal student loan and grant totals overall. Other potential reconciliation proposals include eliminating parent and grad PLUS loans while creating new limits for unsubsidized undergraduate and graduate loans. Under these proposals, low-income students attending institutions with high attendance costs will be impacted the most.

With LGBTQ adults more likely to have federal student loans than non-LGBTQ adults (35 vs. 23%), the elimination of parent PLUS and grad PLUS loans, alongside limiting student aid totals, will result in LGBTQ borrowers with lower incomes relying on higher-interest private student loans to pay the difference or forego higher education altogether. Currently, about 4 out of 10 (43%) LGBTQ adults currently holding federal student loans also have student debt in the form of private student loans from a bank or other lending institution, credit cards, or other loans. This number is likely to increase with the implementation of these proposals.

Conclusion

Through a number of different mechanisms, the Trump administration and Congress are working to end the student loan debt relief provided by the Biden administration, reduce the amount of loans available to college and graduate students, and make such loans more costly and less likely to be discharged. These changes will disproportionately impact LGBTQ adults, who are more likely to have student loan debt than non-LGBTQ adults. In particular, curtailing student loan debt relief would disproportionately impact transgender adults, LBQ cisgender women, LGBTQ people of color, LGBTQ people with disabilities, and LGBTQ people who work in the nonprofit sector.

Federal Student Aid Portfolio Summary 2007- 2024, Nat’l Student Loan Data System (last visited Mar. 3, 2025), https://view.officeapps.live.com/ op/view.aspx?src=https%3A%2F%2Fstudentaid.gov%2Fsites%2Fdefault%2Ffiles%2Ffsawg%2Fdatacenter%2Flibrary%2FPortfolioSummary. xls&wdOrigin=BROWSELINK [https://perma.cc/8D2V-CKG6].

Kerith J. Conron et al., Williams Inst., Federal Student Loan Debt Among LGBTQ People 1 (2021), https://williamsinstitute.law.ucla.edu/wp-content/uploads/LGBTQ-Student-Debt-Jul-2021.pdf [https://perma.cc/KZU8-F4UY].

Sara Patridge & Madison Weiss, Project 2025 Would Increase Costs, Block Debt Cancellation for Student Loan Borrowers, Ctr. for Am. Progress (June 24, 2024), https://www.americanprogress.org/article/project-2025-would-increase-costs-block-debt-cancellation-for-student-loan-borrowers/ [https://perma.cc/5AHF-XQSR].

Press Release, Biden-Harris Administration Surpasses 5 Million Borrowers Approved for Student Loan Forgiveness (Jan. 13, 2025), https://www. ed.gov/about/news/press-release/biden-harris-administration-surpasses-5-million-borrowers-approved-student-loan-forgiveness [https://web. archive.org/web/20250113195453/https://www.ed.gov/about/news/press-release/biden-harris-administration-surpasses-5-million-borrowers-approved-student-loan-forgiveness]; Statement from President Joe Biden on Approving Student Debt Cancellation for Over 5 Million Americans (Jan. 13, 2025), https://www.whitehouse.gov/briefing-room/statements-releases/2025/01/13/statement-from-president-joe-biden-on-approving-student-debt-cancellation-for-over-5-million-americans/ [https://web.archive.org/web/20250113175650/https://www.whitehouse.gov/briefing-room/ statements-releases/2025/01/13/statement-from-president-joe-biden-on-approving-student-debt-cancellation-for-over-5-million-americans/].

Bianca D.M. Wilson et al., Williams Inst., LGBT Poverty in the US: Trends at the Onset of COVID-19, at 4 (2023), https://williamsinstitute.law. ucla.edu/wp-content/uploads/LGBT-Poverty-COVID-Feb-2023.pdf [https://perma.cc/WZ2T-SKLM].

Phase 4.2 Cycle 09 Household Pulse Survey: August 20 – September 16, U.S. Census Bureau (Oct. 3, 2024), https://www.census.gov/data/tables/2024/ demo/hhp/cycle09.html [https://perma.cc/4JWW-3E23] (select “Table 2 Employment Status and Sector by Employment, Selected Characteristics”).

M. V. Lee Badgett et al., Williams Inst., LGBT poverty in the United States: A study of differences between sexual orientation and gender identity groups 22 (2019), https://williamsinstitute.law.ucla.edu/wp-content/uploads/National-LGBT-Poverty-Oct-2019.pdf [https://perma.cc/F5EX-B5CC].

Chris R. Surfus, A Statistical Understanding of Disability in the LGBT Community, 10 Statistics and Public Policy 1, 3 (2023), https://www. tandfonline.com/doi/epdf/10.1080/2330443X.2023.2188056?needAccess=true [https://perma.cc/NS8D-PNLU]; While the definitions of disability in BRFSS and Household Pulse are much broader than those who are totally and permanently disabled from working who received student loan debt relief from the Biden administration, the limited information we have about LGBT people’s receipt of SSDI benefits, which would follow a similar definition of disability , also shows that LGB people have higher rates of receiving SSDI than non LGB people. For example, pooled data from 2005- 2009 from the California Health Interview Survey shows that among adult respondents under age 65 years who were retired, disabled or do not usually work, 12% of straight women and 26% of straight men were on SSDI compared with 13% of bisexual women and 29% of bisexual men, and 37% of lesbians and 50% of gay men. Analysis on file with authors.

Nanette Goodman et al., Nat’l Disability Inst., Financial Inequality: Disability, Race and Poverty in America 12 (2019), https://www. nationaldisabilityinstitute.org/wp-content/uploads/2019/02/disability-race-poverty-in-america.pdf [https://perma.cc/7ZZP-YPH8].

Zach Montague, Biden’s Push to Cancel Student Debt Surpasses 5 Million Borrowers, NY Times (Jan. 13, 2025), https://www.nytimes.com/2025/01/13/ us/politics/biden-student-loan-forgiveness.html [https://perma.cc/2QFB-TG4K].

Robert Keith, Cong. Research Service, The Budget Reconciliation Process: Timing of Legislative Action 1 (Megan Lynch rev. ed. 2016), https://crsreports.congress.gov/product/pdf/RL/RL30458 [https://perma.cc/5BRB-ADED].

Barbara Sprunt & Deirdre Walsh, Trump Backs House’s Approach to Budget Plans to Implement his Agenda, Nat’l Pub. Radio (Feb. 19, 2025 at 12:59 ET), https://www.npr.org/2025/02/19/g-s1-49660/trump-house-senate-budget-resolution [https://perma.cc/SC8F-DP9L].

The reconciliation bill debate process only requires a simple majority and is limited to 20 hours in the Senate, meaning a reconciliation bill cannot be filibustered on the Senate floor. Budget Reconciliation Explainer, H. Budget Comm. Democratic Caucus, 2-3 (Jan. 10, 2025), https://democrats-budget. house.gov/sites/evo-subsites/democrats-budget.house.gov/files/evo-media-document/reconciliation-explainer-fy2025.pdf [https://perma.cc/386T-PKK9].

Bernie Becker, Republican Pay-for Menu Sparks Call to Action, Politico (Jan. 20, 2025 at 10 ET), https://www.politico.com/newsletters/weekly-tax/2025/01/20/republican-pay-for-menu-sparks-call-to-action-00199233 [https://perma.cc/UU9V-QBGL]; Madison Weiss & Sara Partridge, Proposed Legislation Threatens To Raise Costs for Student Borrowers and Dismantle Consumer Protections, Ctr. for Am. Progress (Feb. 4, 2025), https://www.americanprogress.org/article/proposed-legislation-threatens-to-raise-costs-for-student-borrowers-and-dismantle-consumer-protections/ [https://perma.cc/44UH-PXR4].

Michele Zampini & Ellie Bruecker, Ph.D., House Republican Plan Would Spike Student Loan Payments and Sentence Many to a Lifetime of Debt, The Inst. for College Access & Success (Jan. 30, 2025), https://ticas.org/affordability-2/house-republican-plan-would-spike-student-loan-payments/ [https://perma.cc/3M9D-GPW2].

SAVE Plan Court Actions: Impact on Borrowers, U.S. Dep’t of Educ. (last visited Mar. 3, 2025), https://studentaid.gov/announcements-events/save-court-actions [https://perma.cc/HM6V-SBPT].

Katharine Knott, Supreme Court Keeps Debt-Relief Plan Blocked for Now, Inside Higher Ed (Aug. 29, 2024), https://www.insidehighered.com/ news/government/student-aid-policy/2024/08/29/supreme-court-keeps-bidens-save-plan-blocked-now [https://perma.cc/FFE6-ZDVX].

Cory Turner & Steve Inskeep, Federal Student Loan Borrowers Await Court Decision on Repayment Plan, Nat’l Pub. Radio (Jan. 8, 2025 at 4:30 ET), https://www.npr.org/2025/01/08/nx-s1-5250031/federal-student-loan-borrowers-await-court-decision-on-repayment-plan [https://perma. cc/2TFA-2M3C]; While new applications for IDR plans are no longer being accepted, borrowers can still currently submit a paper loan consolidation application. SAVE Plan Court Actions: Impact on Borrowers, U.S. Dep’t of Educ. (last visited Mar. 3, 2025), https://studentaid.gov/announcements-events/save-court-actions [https://perma.cc/HM6V-SBPT].

Madison Weiss & Sara Partridge, supra note 3.

Id.

Id.

Lexi Lonas Cochran & Sophia Vento, Trump signs executive order limiting eligibility for Public Service Loan Forgiveness, Hill (Mar. 7, 2025 at 10:52 PM ET), https://thehill.com/homenews/education/5182839-trump-signs-executive-order-limiting-eligibility-for-public-service-loan-forgiveness/.

Maria Carrasco & Hugh T. Ferguson, Trump Directs ED to Revise PSLF Eligibility Citing Concern Over ‘Illegal’ Activities, Nat’l Ass’n of Student Fin. Aid Adm’r (Mar. 10, 2025), https://www.nasfaa.org/news-item/35799/Trump_Directs_ED_to_Revise_PSLF_Eligibility_Citing_Concern_Over_Illegal_Activities.

President Donald Trump, Executive Order: Restoring Public Service Loan Forgiveness, White House (Mar. 7, 2025), https://www.whitehouse.gov/ presidential-actions/2025/03/restoring-public-service-loan-forgiveness/.

“Protecting Children from chemical and Surgical Mutilation”: Exec. Order No. 14187, 90 Fed. Reg. 8771 (Feb. 3, 2025).

Zach Montague, supra note 10.

H.R.9495, 118th Cong. (2nd Sess. 2024), https://www.congress.gov/118/bills/hr9495/BILLS-118hr9495rds.pdf [https://perma.cc/23GS-6B7F].

Or any payments made before the non-profit had tax exemption status. Public Service Loan Forgiveness (PSLF), U.S. Dep’t of Educ. (last visited Mar. 3, 2025), https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service [https://perma.cc/R2HV-9BHF?type=standard].

Id.

Other tax related proposals include eliminating the up to $2,500 deduction on taxable income for student loan interest for borrowers. Staff of H., 119th Cong., Rep. on FY25 Reconciliation Options 28 (2025), Comm. on the Budget[https://www.politico.com/f/?id=00000194-74a8-d40a-ab9e- 7fbc70940000 ] (This document was leaked to Politico on Jan. 17, 2025). https://perma.cc/AGE7-8DBQ

Mary Ellen Flannery, Project 2025 and Higher Education, Nat’l Educ. Assoc. (Oct. 5, 2024), https://www.nea.org/nea-today/all-news-articles/ project-2025-and-higher-education [https://perma.cc/SX86-7TGJ].

Nandita Bose & Kanishka Singh, Trump says he wants Education Department to be closed immediately, Reuters (Feb. 13, 2025 at 8:41 PT), https:// www.reuters.com/world/us/trump-says-he-wants-education-department-be-closed-immediately-2025-02-12/ [https://perma.cc/W73G-FB4W].

Robert Farrington, Republican Bill To End The Department Of Education Introduced, Forbes (Nov. 26, 2024 at 12:07 ET), https://www.forbes.com/ sites/robertfarrington/2024/11/26/republican-bill-to-end-the-department-of-education-introduced/ [https://perma.cc/U553-2X6T].

“Payments would fund new Promoting Real Opportunities to Maximize Investments and Savings in Education (PROMISE) grants, which would be made to eligible postsecondary education institutions to help improve affordability and promote success for students.” Staff of H. Comm. on the Budget, supra note 26, at 28.

Id.

H.R. 713, 119th Cong. (1st Sess. 2025), https://www.congress.gov/119/bills/hr713/BILLS-119hr713ih.pdf [https://perma.cc/V8BR-FPZ7].

Currently, the maximum Federal Pell Grant award is $7,395 for the 2024–25 award year (July 1, 2024, to June 30, 2025). Federal Pell Grants, U.S. Dep’t of Educ. (last visited Mar. 3, 2025), https://studentaid.gov/understand-aid/types/grants/pell [https://perma.cc/H7Y2-5BFR].

The reconciliation options document also included “and/or expanding Pell grant eligibility to short-term credential programs” with not much more detail. Staff of H. Comm. on the Budget, supra note 26, at 31. more detail.

Id. at 29-30; These potential proposals mirror Alabama Senator Tommy Tuberville’s recently introduced S. 308, which if passed would “modify the annual and aggregate limits of Federal Unsubsidized Stafford Loans for graduate and professional students, and to terminate Federal Direct PLUS Loans for graduate and professional students.” S. 308, 119th Cong. (1st Sess. 2025), https://www.congress.gov/bill/119th-congress/senate-bill/308 [https://perma.cc/C7E5-2JT4].

Conron et al., supra note 2, at 3.

Private student loans are not eligible for federal student loan repayment nor forgiveness options. Options for private student loan repayment depend on the lender and loan agreement. Options for repaying your private education loan, U.S. Consumer Fin. Protection Bureau (last visited Mar. 3, 2025), https://www.consumerfinance.gov/paying-for-college/repay-student-debt/private-student-loans/ [https://perma.cc/5Q85-WCWG]; H.R. 138, 118th Cong. (1st Sess. 2023), https://www.congress.gov/118/bills/hr138/BILLS-118hr138ih.pdf [https://perma.cc/BX8R-39BG] (Under current law, student loans may be discharged in bankruptcy only if the loans impose an undue hardship on the debtor).

Conron et al., supra note 2, at 4.